Filing Personal Taxes in Colombia: A Comprehensive Guide

Authors:

María Cristina Estrada, CPA (COL)

Alan Gongora, Esq. (NY)

TOPIC SUMMARY

This article provides foreigners with a comprehensive summary of the tax filing process in Colombia for individuals. It is intended to provide general information only. You should consult with your own local accountant if you proceed with an actual tax filing.

WHO NEEDS TO FILE A PERSONAL TAX RETURN IN COLOMBIA?

- Colombian Citizens who meet certain asset and income thresholds

- Colombian Dual Citizens who meet certain asset and income thresholds

- Foreign tax residents who meet certain asset and income thresholds (see below)

- Foreign non-tax residents who engage in certain financial/investment transactions in Colombia and/or involving Colombian-based parties (see below)

I’M A FOREIGNER. HOW DO I KNOW IF I NEED TO FILE?

Below is a step-by-step summary that will help you determine whether you need to file a local tax return:

STEP 1: Determine if You Were a Tax Resident in 2020

The relevant question here is as follows: were you physically present in Colombia more than 183 days within any 365 day period ending at any time during 2020? This means that you could be a tax resident if you exceeded the 183 day threshold by either (1) spending time in Colombia in 2019 AND in 2020 OR (2) only in 2020.

- Example #1: You did NOT exceed 183 days during the 2020 calendar year:

- Scenario: You were NOT physically present in Colombia in 2019 but you WERE physically present in Colombia in 2020 as follows:

- January 1, 2020 through March 1, 2020

- Analysis: You were NOT physically present in Colombia in excess of 183 days in 2020

- Conclusion: 1. you were NOT a tax resident in Colombia in 2020 AND 2. may need to file taxes in Colombia ONLY IF you engaged in certain financial/investment transactions in Colombia (see “Determine if You Engaged in Financial/Investment Transactions in 2020” below)

- Example #2: You DID exceed 183 days during the 2020 calendar year:

- Scenario: You were physically present in Colombia as follows:

- January 1, 2020 through August 1, 2020

- Analysis: You were physically present in Colombia in excess of 183 days in 2020

- Conclusion: 1. You were a tax resident in Colombia in 2020 AND 2. May need to file taxes in Colombia (see “Determine whether you actually have to file” below)

- Example #3: You were physically present in Colombia in 2019 and exceeded 183 days in 2020:

- Scenario: You were physically present in Colombia as follows:

- August 1, 2019 through December 31, 2019 AND THEN

- June 1, 2020 through August 1, 2020

- Analysis: You were physically present in Colombia in excess of 183 days between 2019 and 2020, ending in 2020.

- Conclusion: 1. you were a tax resident in Colombia in 2020 AND 2. may need to file taxes in Colombia (see “Determine Whether You Actually Have to File” below)

STEP 2: Determine if You Engaged in Financial/Investment Transactions in 2020

Even if you were not a tax resident in 2020, you may still be required to file taxes in Colombia. This could happen if you engaged in certain Colombian-related activities including, but not limited to:

- selling property in Colombia;

- starting a business in Colombia

- working for a Colombian-based company;

- loaning/borrowing funds to/from a Colombian citizen/resident; and

- providing services to local clients.

Do check with your local accountant to make sure that you have no filing obligations based on your activities in Colombia. However, in general, if you can confirm that you 1. were NOT a tax resident in Colombia in 2020 AND 2. had NO Colombian-related activities in 2020 then you likely have no filing obligations for 2020.

STEP 3: Determine Whether you Actually Have to File

Even if you 1. were a tax resident in 2020 and/or 2. engaged in certain Colombian-related activities it doesn’t necessarily mean you actually have to file taxes in Colombia. You would be required to file taxes if:

- the value of your total assets WORLDWIDE exceeded approx. COP$160M , OR

- your total annual WORLDWIDE income exceeded approx. COP$50M, OR

- your total WORLDWIDE purchases via a credit/debit card exceeded approx. COP$50M, OR

- your total WORLDWIDE purchases via any other method exceeded approx. COP$50M, OR

- your total WORLDWIDE banking activity (deposits, transfers, etc.)/financial investments exceed approx. COP$50M.

Note that there is some debate in the accounting/tax community in Colombia as to whether these thresholds should measure Colombian-only activity or whether they need to include activity on a worldwide basis. Our accountants interpret the relevant rules to include worldwide activity.

I NEED TO FILE. DO I HAVE TO PAY TAXES IN COLOMBIA?

Having to file a tax return does not necessarily mean that you will have to pay any taxes in Colombia. Here are some things that will impact your actual tax obligations in Colombia:

- Paying Taxes in Other Jurisdictions: Even if your local accountant determines that you are required to pay local taxes you may still be able to reduce or even eliminate your local tax obligations if you pay taxes in a foreign country. From experience, we can tell you that many of our clients do not end up paying any local taxes because they can offset those foreign tax payments against local tax obligations. Do check with your accountant to see if you can actually utilize this process to mitigate your own tax obligations.

- Higher Income Total: Obviously, the more income you recognize the higher your local tax obligations will tend to be.

- Source of Income: As in other jurisdictions, Colombia taxes certain income sources differently. For example, someone who earns a salary may be subject to a higher tax than someone who receives income from dividends.

- Available Deductions: As in other jurisdictions, Colombia offers specific tax deductions that you can use to minimize your tax obligations. These include child care, education, etc…

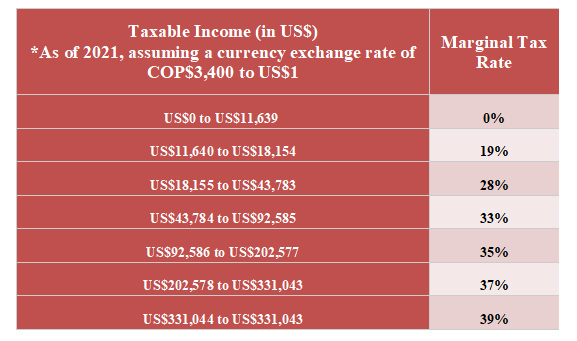

- Applicable Tax Rate: As in other jurisdictions, Colombia implements a progressive tax collection structure. This means that the higher your taxable income the higher the rate that is used to tax you. Below is a breakdown of Colombian’s tax brackets for 2021:

The rates for fiscal residents (nationals or foreign) applicable to the general income basket and pension income basket (see below) are:

I NEED TO FILE. WHAT HAPPENS NEXT?

In order to file a tax return we recommend that you proceed as follows:

STEP 1: Retain a Competent Local Accountant

You can certainly retain our firm. However, note that there are plenty of reputable accountants in the local market. Make sure that you retain someone who is experienced with filing tax returns for foreign clients.

STEP 2: Get a Local Tax ID

Before you can even file a local tax return you need to obtain a local tax ID (the so-called “RUT”). This ID is used by the local tax authority (the “DIAN”) to identify you throughout the tax filing process. We recommend that you secure a RUT as soon as possible in advance of your filing deadline to ensure you are not subject to any late penalties once you actually file. Keep in mind that it can sometimes take weeks or even months to secure a RUT.

STEP 3: Collect Relevant Documentation

The documentation you will need to provide to your accountant in order to prepare an official tax return is similar to what you probably provide to your own accountant back home. Below is a non-exhaustive summary of the info/documentation our own accountants request from our foreign clients as part of the tax filing process.

1. GENERAL INFO

a. A list of all your nationalities.

b. A list of all countries where you are considered a resident.

c. Copies of all personal tax returns filed worldwide.

d. Copies of all tax returns for any business entity you own filed worldwide.

2. CALCULATING WORLWIDE ASSETS

a. All ANNUAL financial statements (banking, brokerage, etc…) for financial accounts in your name worldwide.

i. This is a single financial statement covering the entire year.

ii. For COLOMBIAN accounts, note that banks usually circulate annualized statements around March every year or you can request it directly at your bank branch office.

b. Documentation of ownership for all securities in your name (stocks, bonds, CDs, etc…) worldwide.

c. Titles/deeds to any registered asset (house, car, etc…) worldwide.

d. Statements showing payment of any property taxes worldwide.

e. Documentation relevant to the sale of any asset (real estate, car, etc…) worldwide.

f. Documentation (loan agreements, mortgages, promissory notes, etc…) showing the lending of any funds to any third party worldwide.

3. CALCULATING WORLDWIDE INCOME

a. Documentation showing total employment income worldwide

i. If you were an employee of a COLOMBIAN company note that they would have been obligated to share this certificate in March every year.

b. Documentation showing any income received from additional employment benefits (bonuses, working extra hours, etc…) worldwide.

c. Documentation showing total income received as an independent contractor worldwide.

i. If you provide services in Colombia, any certificates showing total tax withholding.

d. Documentation showing any retirement income worldwide.

e. Documentation showing any unemployment or disability income.

f. Documentation showing any shareholder income and/or dividends from any business entity worldwide.

g. Documentation showing totals for other income (rental income, scholarships, fellowships, inheritances, gambling winnings, etc.) worldwide.

4. CALCULATING ANY DEDUCTIONS

a. If you own a solo proprietorship (a business that is not registered as a company) a list of all applicable business expenses with receipts.

i. Ideally, we would receive a breakdown via Excel.

b. If you own property

i. List of expenses related to improvements, mortgages, rental expenses, management expenses, etc…. with receipts.

c. List of health care expenses (health care premiums, out of pocket expenses, etc…) with receipts.

i. If you have an employee health plan, your employer should have provided a certificate showing many of these payments.

d. List of all tax payments with receipts/certificates.

e. If you have dependents (children below 18 or below 23 if they are still in school) or a spouse:

i. A letter or document certifying this.

f. Documentation showing expenses related to educational programs for yourself or your dependents.

g. Certificates showing charitable payments.

We recommend that you start collecting all relevant documentation as soon as possible to avoid any delays in the tax filing process. Keep in mind that it may take a while to secure some of this documentation given that it may only be issued by foreign (non-Colombian) governmental and private entities.

STEP 4: Prepare a Tax Return

You will need to coordinate with your local accountant to ensure that you provide all relevant information/documentation and that you answer all relevant questions prior to filing. Assuming you already have your RUT and your filing is pretty straightforward a competent local accountant should be able to finalize your return within just a couple of days. If (i) your return is particularly complex; (ii) you don’t current have a valid RUT; and/or (iii) securing relevant documentation is particularly time consuming, the tax return process may be delayed for weeks or even months.

WHEN DO I NEED TO FILE?

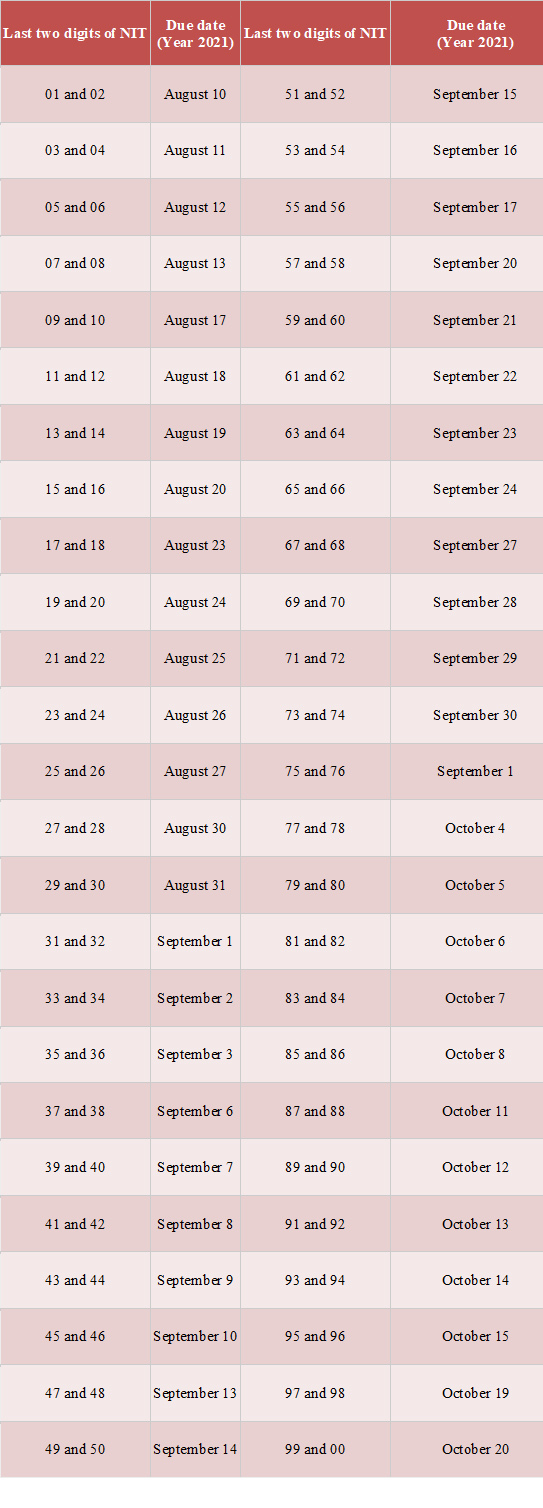

Local deadlines to file a personal tax return are based on the last 2 digits of your local tax ID number. Remember that if you fail to file your tax return on time you will be subject to late penalties. Below is a breakdown of these deadlines:

CAN I FILE A LOCAL TAX RETURN ON MY OWN?

Definitely NOT recommended. Besides the significant language barrier facing many foreigners, interpreting applicable tax and accounting rules for someone who is not trained as a local accountant will prove to be a significant barrier to a successful filing.

WHAT HAPPENS IF I DON’T FILE?

We get this question a lot. The short answer is that if you fail to file a local tax return you could technically be subject to pretty extensive fines and penalties depending on a number of factors including your taxable income, the value of your worldwide assets and the number of years you fail to file a return.

In practice, the actual consequences of not filing can vary widely. Here are some specific risk scenarios that can help you decide whether it makes sense to file:

- Foreign Tourists. Occasionally, foreign tourists may inadvertently become tax residents and are technically required to file a local tax return. However, assuming these foreign tourists do not plan to work, invest, retire or otherwise have any long-term ties to Colombia, the current risk level involved in not filing is fairly manageable.

- Foreign Residents. If you plan to actually reside in Colombia the risk involved in not filing a local tax return increases substantially, particularly for foreigners who own businesses and/or invest in local assets like real estate. It is not uncommon for local tax authorities to attempt to seize personal assets in order to satisfy local tax obligations.

- Non-Resident Foreigners Engaged in Business/Investment Activities. If you do not intend to reside in Colombia long-term but are otherwise engaged in specific business and/or investment activities in Colombia, the risk involved in not filing a local tax return is similar to that faced by foreign residents. While you may not be physically present in Colombia, local tax authorities can still seek to attach and seize local assets as a way to pressure you to pay any local tax obligations.

It should be noted that tax collection has become a significant imperative for the Colombian government as a result of the massive economic downturn caused by the Covid pandemic. We expect tax enforcement to ramp up as the local government attempts to secure as much tax revenue as possible over the medium and long-term.

RELEVANT SOURCES

- Local Tax Authority (“Direccion de Impuestos y Aduanas Nacionales”):

- Local Contact Info for DIAN:

- Local DIAN Offices:

- Local Tax ID (“RUT”):

RELEVANT LEGAL/REGULATORY CITATIONS

Law 1943, 2018

Law 1819, 2016

Resolution N° 52 of June 21, 2016

Resolution N° 55 of June 14, 2016

This post is being published for general informational purposes only and it is not intended to provide specific legal and/or tax advice. It should not be used as a substitute for competent legal/tax advice from a licensed attorney and/or accountant in your jurisdiction.